Back in 1965, a man in Omaha entrusted his life savings 67k $ his neighbor, Warren Buffett.

In 1965, a man and woman in Omaha were facing a difficult problem – but very common. A problem that is quite common for many middle -aged couples: How do you plan properly for pension? On the plus side, thanks to the diligent savings habits and a small heritage, Dorothy and the Syrqe Myer were actually ahead of most of their peers when it came to pension planning. Myer was a respected rabbi and scholar who gained a doctorate. in philosophy from Jewish Theological Seminar. Dorothy was an author of the children’s book whose work presented generations of Jewish families of moral and spiritual values through titles as “Let’s talk about God” and “Let’s talk about just and wrong.” Together, they lived a thoughtful life, guided by values rooted in faith, teaching and community. Impressive, by 1965, the salt had managed to throw away approximately $ 67,000. FYI, this is equal to about $ 650,000 today after adjusting inflation.

This was the good news. The bad news was that they needed to protect and increase the savings, so it would still be there when they were ready to retire in a decade or two. After months of stressful debate, Dorothy offered her husband some simple tips:

“Myer, invest the money with your friend, Warren”

This friend Dorothy was referring to was a 35-year-old neighbor who had recently gained a positive local reputation for money management in their small town of Omaha, Nebraska. Kripkes had known man over random bridge games and holidays for vacation. Myer was very embarrassed to seek help. He eventually repented. Thank God.

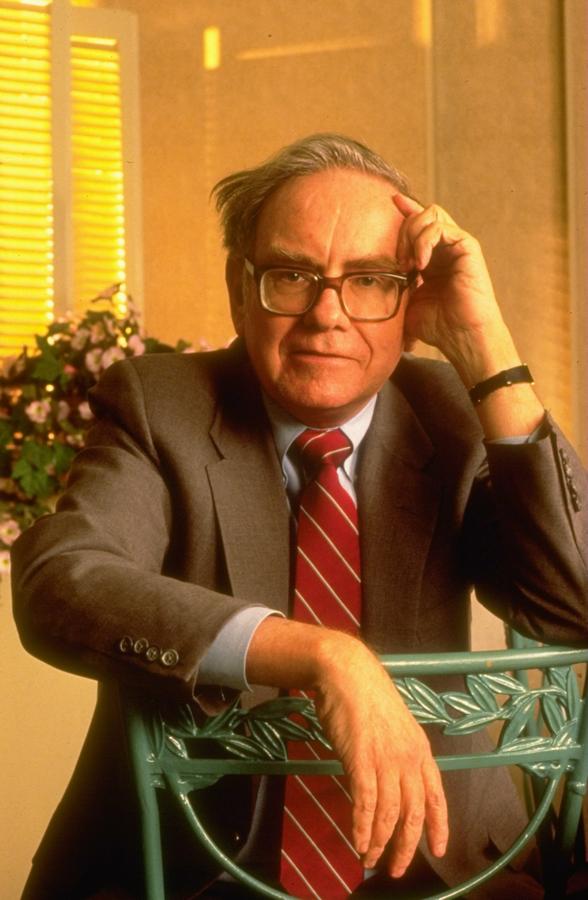

Their neighbor agreed without hesitation. His name?

Warren Edward Buffett

(Photo by Rob Kinmonth/Getty Images)

While you have probably found so far, Dorothy and Myer Krykika accidentally tried a man who would eventually be considered one of the greatest financial investors of all time. A local business man whose investment would one day manage approximately 500 billion dollars in wealth. A man who is the fourth richest person in the world today, with a personal net value $ 160 billion.

Of course, we are talking about Oracle of Omaha himself, Warren Buffett.

Syrk Wed was very reluctant to ask the new upper money manager to handle their life savings. For one thing, he thought he would be seen as a big imposition. Second, Myer worried about mixing business and friendships. But most importantly, he knew that at the time, the minimum Warren investment limit was $ 150,000. So there was no point in raising it!

Dorothy and myer salt

Thankfully, Dorothy did not allow those hesitations to take the road. But believe it or not, Myer resisted to reach Warren for Three years! Finally, Myer repented. Warren agreed to manage the money without hesitation for a second. In Warren’s own words:

“I liked the boy (and) I wanted people who, if they were going to go wrong, we could still be friends.“

Fortunately for both men, things didn’t go wrong. Over the next thirty years, Warren’s business expanded at an exponential pace. And along the way, $ 67,000 of myer life savings and Dorothy Krytik were transmitted just as fast. In its own words:

“We got very early with a modest amount of money. Then he fungal like an atomic bomb.“

Very soon, salt were millionaires. Then many millionaires. Incredible, by the mid -1990s, their $ 67,000 life savings were fungal in more than $ 25 million. This is the same as approximately $ 40 million today, as it was regulated for inflation.

In the mid -1990s, the price of Berkshire Hathaway shares rose between $ 20,000 and $ 40,000 per share. Let’s share the change and use $ 30,000 per share to assess how much shares owned salt. If the salt was worth $ 25 million in the mid -1990s with $ 30,000 per share, it means they owned about 833 Berkshire Hathaway shares. If they never sell a single action, at a time when Dorothy died in September 2000, they would be worth $ 50 million. By the time Myer died in May 2014, with the trading of Berkshire shares with $ 215,000 per share, their 833 shares would have been worth $ 180 million. Someone who owns 833 shares of Berkshire Hathaway today will be worth…

674,570,064 dollars

This is about $ 700 million. By an investment of $ 67,000.

Warren Buffett – Dexter Shoes / Dimitrios Cambouris / Getty Images

So how did my life and Dorothy changed as they became millionaires, then many millionaires, and eventually $ 50-150 million?

Lyudiously as they became rich, Myer and Dorothy never stopped living a very humble life. They never bought a house. They continued to rent a modest three bedroom apartment for $ 900 a month. Myer, a ordained rabbi, continued to work in his local synagogue, earning a salary of $ 30,000 a year.

Their greatest pleasure turned out to be philanthropy. Throughout their lives, this amazing couple donated millions of dollars to a number of charities. They donated $ 7 million to help rebuild a library at the Jewish Theological Seminar in Manhattan. The salt first met each other as students outside this library many decades ago. They eventually donated an additional $ 8 million to their Alma Mater.

Dorothy Krykika died in September 2000 at the age of 88, and Myer died in May 2014 at the age of 100.

Myer and Dorothy Krika lived modestly, gave generously and made some of the richest people – and the most generous – in Omaha. They do not buy yachts or private planes. They did not improve their apartment. They believed in ideas, people, and in the passage of knowledge and kindness ahead. While their $ 67,000 investment could be worth nearly $ 700 million today, the real heritage they left was not financial – it was philosophical. In a world fixed with wealth, salt are a reminder that the richest life can be determined not by what you keep but by what you give you.

(function () {

VAR _FBQ = window._fbq || (window._fbq = ());

If (! _fbq.Loaded) {

VAR FBDS = Document.Createement (‘Scenario’);

fbds.async = true;

FBDS.SRC = “

var s = document.GELEMENTSBYTAGNAME (‘Scenario’) (0);

S.Parrentnode.insertbefore (FBDS, S);

_FBQ.Loaded = true;

}

_fbq.push (‘Addpixelid’, ‘1471602713096627’));

}) ();

window._fbq = window._fbq || ();

window._fbq.push (‘track’, ‘pixelinitized’, {}));